Although our unseasonably cold weather may not show it, we are getting ready to embark on our spring buying season. I’m expecting both the market and the weather are going to begin heating up. I’ve already seen a pickup in demand and sales activity, while new inventory is still getting absorbed far too quickly when priced right.

Everyone waiting for the bottom to drop out of this market… we may already be past the bottom and building a base for the next run up in pricing. Interest rates shot up over 1% to end the month of February, yet pending home sales increased. Either prices came down enough that affordability is more attainable or the psychology around the higher rates is changing.

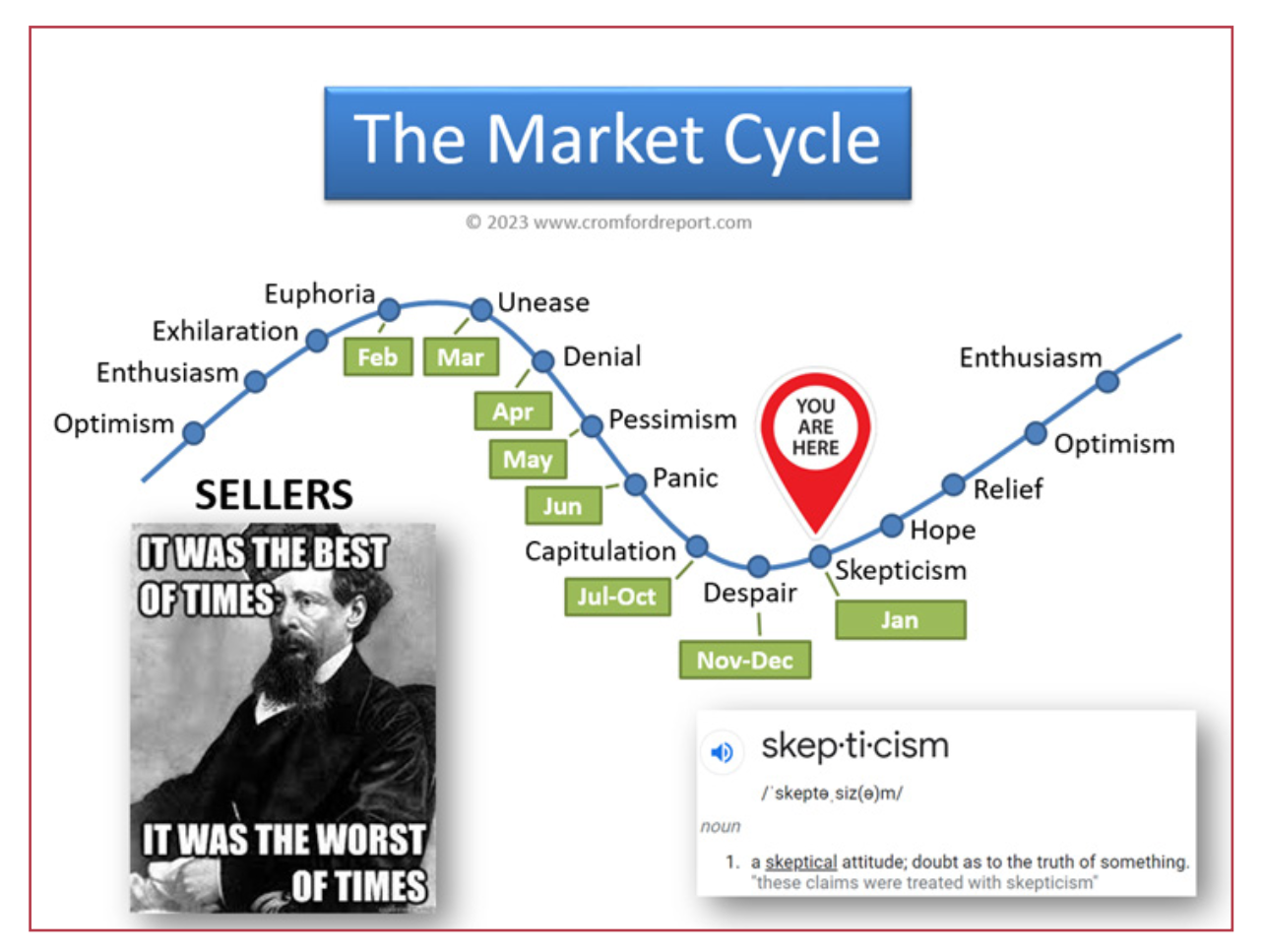

The major Phoenix area real estate market researcher, The Cromford Report, put this graphic together showing the rapid shifts in housing cycles we have been through in a period of about 10 months. Basically going from a sellers market, to a balanced market, to a buyers market, and back to balanced with a trajectory of hitting a sellers market soon as new inventory supply continues to stay low compared to pent up housing demand.

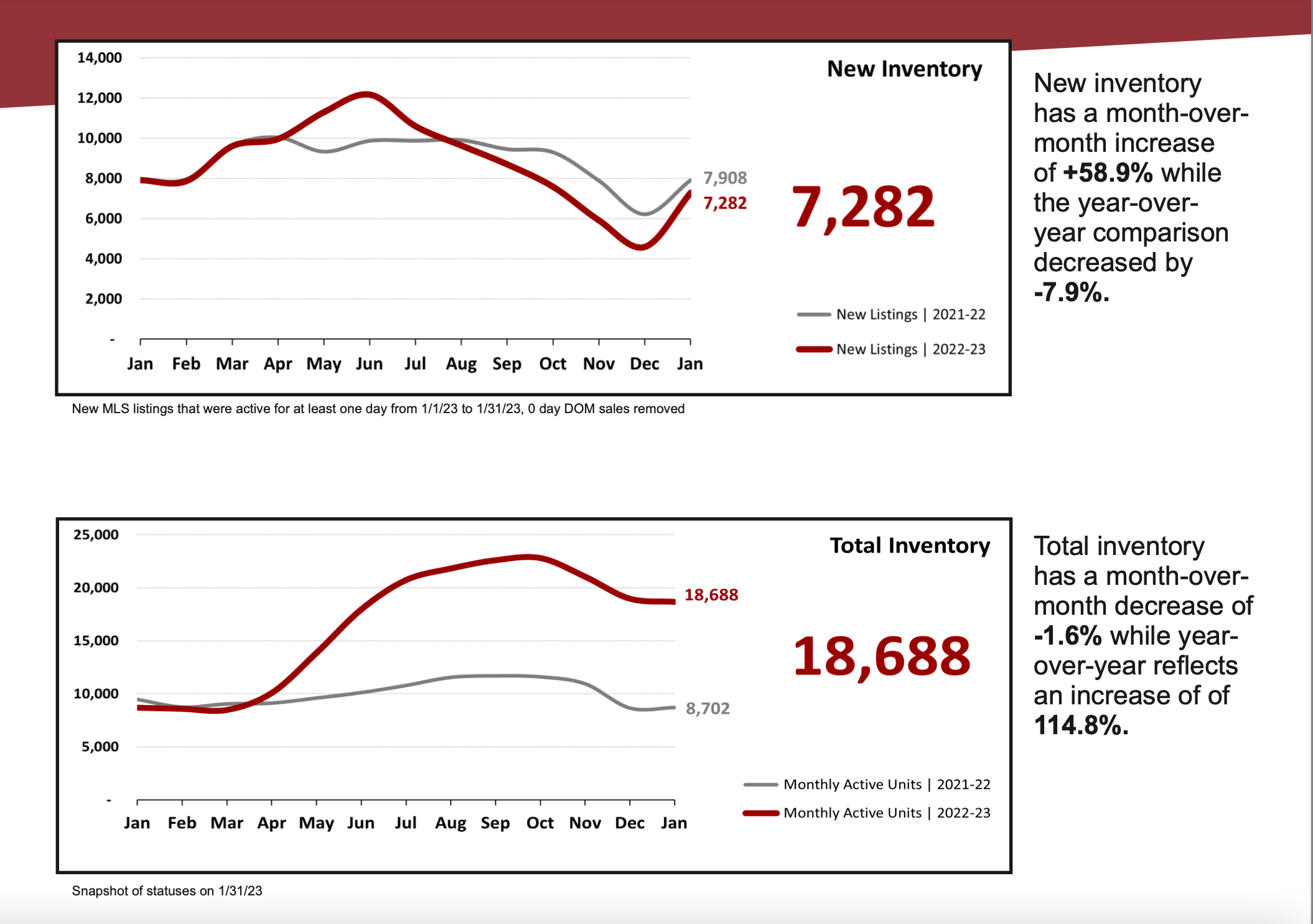

Overall housing supply has stayed flat, even with an increase in new listings. There seems to be 2 buckets of listings on the market. Stagnant homes that have been on the market for 100+ days and those that sell in 2 weeks. You will see from the charts below that new list prices have shot up over the past month. If we get meaningful relief on rates, the top is going to pop off this market and back to the races with a competitive market.

If you would like to take advantage of discounted purchase prices while avoiding multiple offers and waiving contingencies, this could be your best opportunity to buy. Yes, the mortgage rates aren’t ideal, but they aren’t constant. There should be a great refinance opportunity in 12-24 months. Timing a market is almost impossible. There is a give and take between pricing and rates that must be considered.